Credit Stacking

With credit stacking, even a new business can get access to up to $150,000 in funds.

Explore the Benefits

Learn More About Credit Stacking

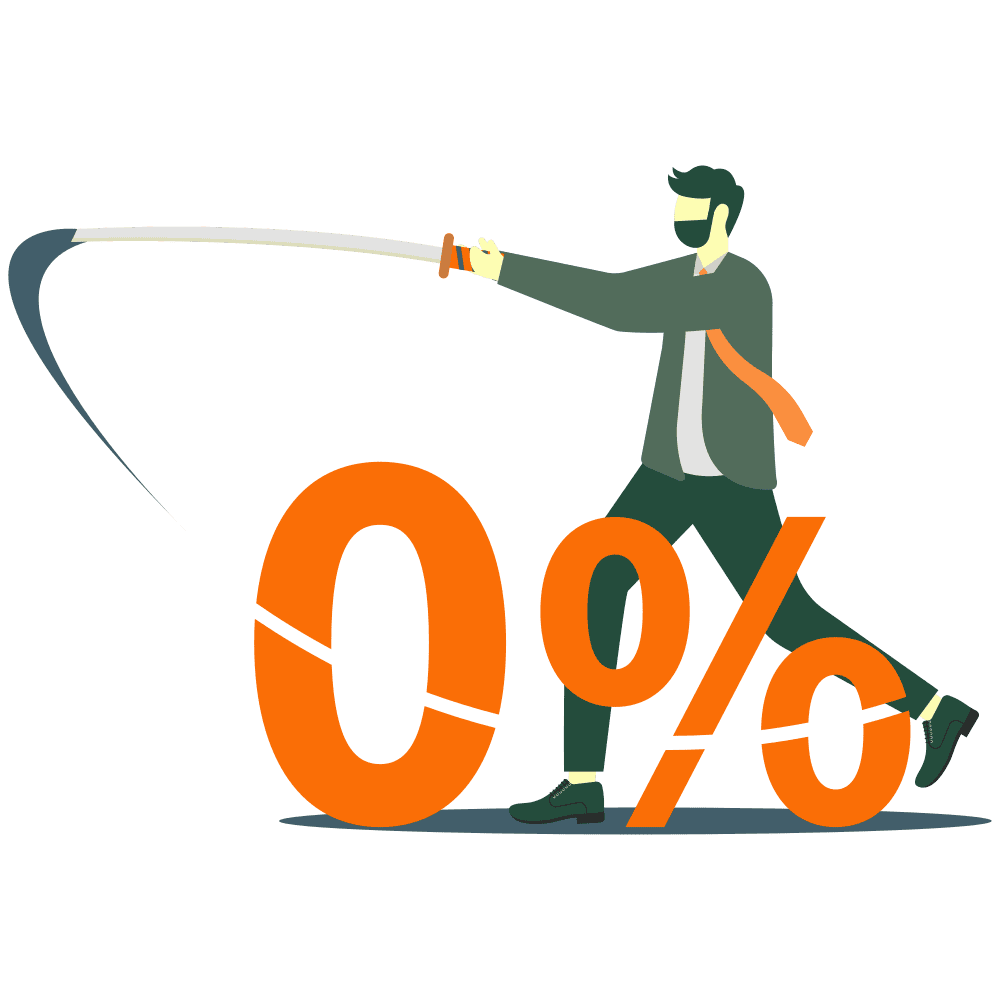

Have you faced challenges finding and securing the best credit cards for your business? We are experts in finding credit cards that offer the right terms and conditions, including 0% interest up to 20 months, AND we help you apply for multiple cards, granting you up to $250,000 in available funding that you can use toward any legitimate business expense.

Our strategic approach to credit card application can avoid immediate negative impacts on your credit score. We help you access multiple cards at one time, swiftly increasing your credit access. Because we target cards with 0% interest you have a natural runway. You’ll strategize your growth plan and future financing strategy based on your available capital and length of time before repayment becomes due.

Lenders in Network

In Available Funds

Fastest Close

Flexible

Loan Options

Unlock unparalleled access to business funding with our Credit Stacking services, designed for businesses that might not qualify for SBA or traditional loans. Gain up to $250,000 in unsecured funds with a 0% interest rate for up to 20 months, providing the financial freedom to invest in growth.

Access Business Funding

Even businesses that are ineligible for SBA or traditional loans due to time in business or lack of hard assets CAN gain access to business capital.

Unsecured funds

Increase flexibility

Businesses with only one credit card risk having their card cancelled or the limit reduced. With multiple cards, we make credit manageable.

Credit Stacking

Advantages

Get the capital you need to launch and grow.

01

Access revolving credit that can serve your business for years.

Get up to 20 months at 0% interest.

03

Earn incentives on unsecured credit purchases for your business.

04